All Categories

Featured

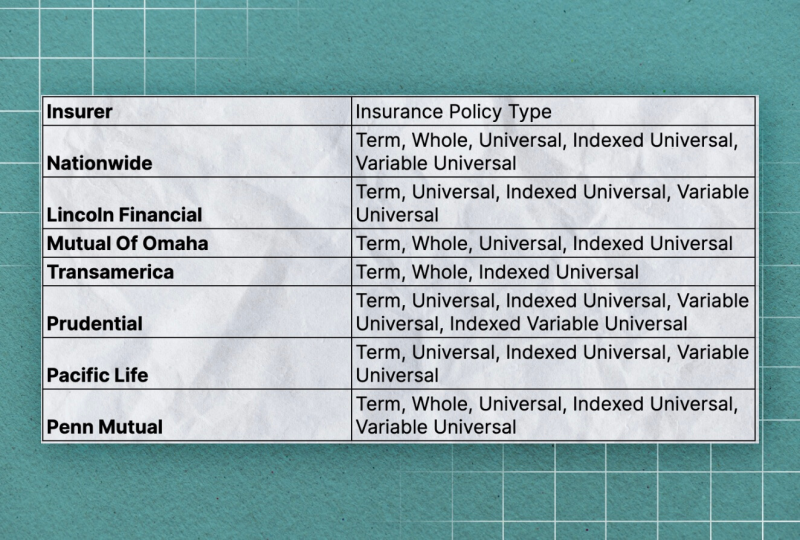

State Ranch agents sell whatever from home owners to car, life, and other prominent insurance items. It's very easy for agents to bundle solutions for discounts and easy strategy monitoring. Lots of clients enjoy having actually one relied on agent manage all their insurance requires. State Ranch provides global, survivorship, and joint global life insurance policy policies.

State Farm life insurance is usually traditional, providing steady choices for the average American family. If you're looking for the wealth-building opportunities of global life, State Ranch lacks competitive options.

It does not have a solid visibility in other monetary products (like global strategies that open up the door for wealth-building). Still, Nationwide life insurance policy plans are very available to American family members. The application procedure can also be a lot more workable. It aids interested events get their first step with a dependable life insurance policy plan without the far more complex discussions concerning investments, economic indices, etc.

Even if the worst takes place and you can not get a larger strategy, having the security of a Nationwide life insurance coverage plan might transform a buyer's end-of-life experience. Insurance policy companies utilize medical exams to assess your danger course when using for life insurance policy.

Customers have the choice to transform prices every month based on life scenarios. Certainly, MassMutual provides interesting and possibly fast-growing opportunities. These plans have a tendency to do best in the long run when early down payments are greater. A MassMutual life insurance coverage agent or economic expert can assist purchasers make strategies with area for modifications to fulfill short-term and long-lasting monetary goals.

My Universal Insurance

Some customers may be surprised that it offers its life insurance policies to the general public. Still, army members appreciate unique benefits. Your USAA plan comes with a Life Event Alternative cyclist.

If your policy doesn't have a no-lapse guarantee, you may even lose coverage if your cash money value dips below a certain threshold. It may not be an excellent alternative for individuals that just desire a death advantage.

There's a handful of metrics through which you can judge an insurer. The J.D. Power customer contentment ranking is a great choice if you want a concept of just how clients like their insurance plan. AM Finest's financial stamina rating is an additional essential metric to think about when choosing an universal life insurance company.

This is especially crucial, as your cash money worth expands based on the investment alternatives that an insurance policy business supplies. You need to see what investment options your insurance service provider offers and compare it against the objectives you have for your policy. The finest way to find life insurance coverage is to accumulate quotes from as several life insurance policy companies as you can to comprehend what you'll pay with each policy.

Latest Posts

Master Iul

Index Universal Life Vs Whole Life

Term Life Vs Universal Life Insurance